Holiday Fraud 2025 – Part 1

Halloween is tomorrow, so why am I writing about Holiday Fraud? For one, there is snow on the ground as I write this in Colorado which makes me think about the holidays. More importantly, if you aren’t already preparing customer and member education or rule and model updates, now is the time.

What to expect with fraud around the holidays:

- Your fraud rules and models will throw more false positives than usual – your customers are buying gifts, so their spending behavior is different.

- You will have less staff to deal with the increased alert volume due to vacation and flu season.

- Fraudsters will attack when they know that no one is on watch – posting about the company holiday party on LinkedIn? You just gave them an invitation.

- Scams, scams, and more scams.

Let’s discuss this in 2 parts:

- Educating your customers and members before they fall victim to scams – this article

- Training models and tuning rules for a dramatic shift in spending behavior – Holiday Fraud 2025 – Part 2

Part 1: Educating your customers and members before they fall victim to scams

Put a banner on the home page of your website about holiday scams. When your compliance or marketing departments push back, tell them you have an obligation to warn customers and members of immediate threats. Remind them that 9 out of 10 people will leave their bank or credit union when impacted by fraud, even when they get their money back.

Fraud doesn’t have to be a source of stress and frustration to your customer or member. That only happens when you react to a fraud event, when that person’s money hangs in the balance while you try to remediate the situation and recover the money.

Imagine turning a fraud event into an opportunity to build trust and loyalty. That happens when you proactively identify and stop fraud before it happens. Before the money moves. It starts with telling our customers and members what to look out for. And it ends with you which I cover in detail in Part 2.

These are my top 7 scams your customers and members need to know about:

- Delivery Scams

- Marketplace Scams

- Gift Card Scams

- Vacation Rental Scams

- Charity Scams

- Holiday Employment Scams

- AI Voice Cloning Scams

General Tips

- AI gets personal – Fraudsters use generative to create realistic messages using your name, recognizable logos, and personal references that look credible.

- Urgency – Pressuring to act quickly so a person doesn’t take time to think.

- Too good to be true – As the saying goes, if it seems too good to be true, it most likely isn’t real.

- Unusual payment methods – Paying by gift card or crypto is always a red flag. Be aware that paying with Zelle, Venmo, or Cash App is no different than handing over cash.

What should you do?

- Share real-world examples with your customers and members on your website with tips they can follow to stay safe.

- Encourage customers and members to report suspicious emails, texts and phone calls.

- Collaborate with other banks and credit unions – fraudsters hit everyone, so share intel.

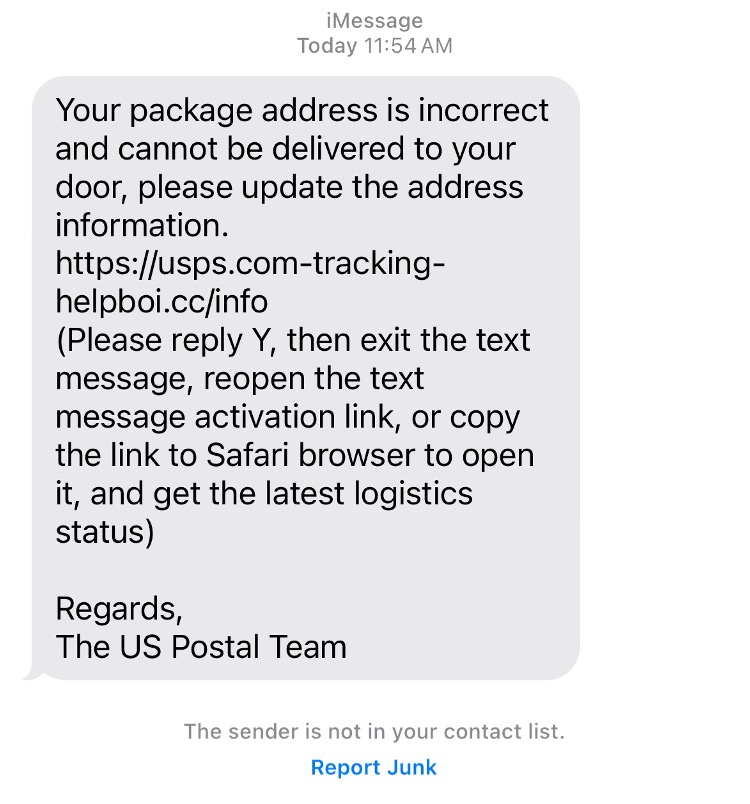

Delivery Scams

This is #1 on my list because our customers and members expect it. An unexpected email or text throughout the year causes most of us to take pause. During the holidays we are anticipating delivery notifications, which makes us vulnerable to fake messages. AI makes them seem real by using your name, carrier logos and potentially referencing a purchase you’ve made before.

Tips for your customers and members

- Ensure the sender’s phone number or email address are legitimate.

- Carefully review URLs which may redirect to a fake site to steak info or install malware.

- It’s always best to go directly to the company or carrier website to look up reference or tracking numbers rather than clicking a link in an unsolicited message.

Marketplace Scams

Everyone is on a budget and sometimes that perfect, hard to find gift can only be found on a marketplace. Especially when it comes to the latest hot item our kids want this year and every local store seems to be out of stock. You can wake up at 4AM, stand in line, and hope to make your child’s dreams or find it online in the comfort of your home, eggnog in hand. No brainer. But mind your eggnog because this is a scam run all year that amplifies over the holidays.

Tips for your customers and members

- Review the seller’s or buyer’s profile. A missing profile photo, lack of friends, no activity are all signs of a fake profile.

- Keep the conversation on the platform. Fraudsters will try to take the conversation off platform, typically to WhatsApp. Marketplaces have safeguards that will warn you if the conversation sounds like a scam. Going off platform, you are on your own.

- Never click or link or share a code to “verify your identity”. This is a common way fraudsters steal your personal information or take over your account.

- Don’t send money until you have the item and meet in a public place to make the exchange. Remember that sending money via Venmo, Zelle, Cash App is the same as sending cash. If something goes wrong, you will not get your money back.

Gift Card Scams

Gift card scams manifest in two ways. The typical gift card scam you see year round involves a fraudster asking your customer or member to purchase gift cards in order to make a payment. They impersonate government agencies, your company’s CEO, tech support, and deep fake relatives experiencing an emergency.

During the holidays, fraudsters offer discounted gift cards on marketplaces and fake websites. Victims are persuaded to purchase them using Venmo, Zelle, or Cash App to purchase gift cards that are stolen and/or contain no value.

Tips for your customers and members

- A government agency, your company’s CEO, and your relative in distress will never ask you to send money using a gift card.

- Discounted gift cards are almost always a scam. Trying to save $5 on a $25 is not worth the risk, you’re most likely going to lose $20 with no recourse.

- Remember that sending money via Venmo, Zelle, Cash App is the same as sending cash. If something goes wrong, you will not get your money back.

Vacation Rental Scams

Two and a half years ago my wife and I tried out the travel lifestyle… and we love it! I’m not talking about RV life. We are not retired and both work from home, so we live full time in vacation rentals. We also use them when visiting family over the holidays. Imagine getting on a plane or taking a long drive, excited to spend time with family, only to learn that your vacation rental reservation is not real. Hotels are fully booked, and you have nowhere to go.

Tips for your customers and members

- Be aware of discounted travel deals and unrealistic prices.

- Make sure that your host and the property have reviews, and that they are spaced over a period of time. If you see multiple 5 star reviews in a short period of time, they may not be real.

- Keep conversations with hosts on booking platforms like Air BnB and VRBO. They have safeguards that will warn you if the conversation sounds like a scam. If you go off platform, you’re on your own.

- Pay with a credit card so you have some protection. Paying off platform via Venmo, Zelle or Cash App is no different than handing over cash.

Charity Scams

In my opinion, there is a special place in hell for fraudsters who commit charity scams. I feel the same about elderly scams, but we’ll cover that in another post. Legitimate charities make a big push during the holidays when your customers and members are feeling generous. Generosity is a good thing, until it is exploited. Help your customers know the difference between a real charity and a scam. They will appreciate it, and you won’t have to deal with fraud claims and SARs right after the New Year.

Image courtesy of ClipZone on YouTube

Tips for your customers and members

- Look for typical signs of phishing even if you’ve donated to the charity in the past: legitimate from email, phone number, and website link. Remember that AI can make charity solicitations appear real.

- When in doubt, go to the charity website directly rather than using links in email or text messages.

- Verify the charity if you haven’t heard of it before. The Better Business Bureau has a website give.org that you can use.

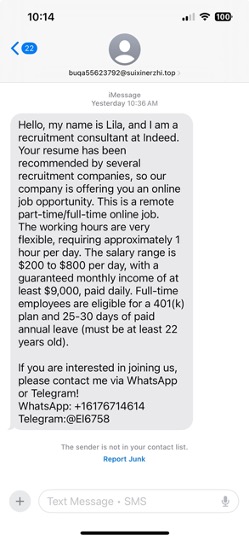

Holiday Employment Scams

This year’s job market has been rampant with employment scams, giving fraudsters an opportunity to hone their skills with the help of AI. Many companies need seasonal help, and many people want some extra cash for the holidays. Too good to be true text messages offering $100-$600 per day for 1-2 hours of work from home are very common. Who wouldn’t want to earn that kind of cash by spending a couple of hours online at home? Fraudsters take advantage of this by offering fake employment to scam a person out of their personal information, make a fraudulent transaction, or be complicit in money-laundering. Read more about Employment Scams.

Tips for your customers and members

- Legitimate companies are not offering $100-$600 per day for 1-2 hours of work from home. If they were, everyone would do it. The goal is to obtain personal information to verify your identity which will be stolen or worse, convince you to pay for equipment (laptop, phone, etc) that will never arrive.

- Most holiday employment is in retail and in person. If you are offered a job to repackage and ship anything, you are being duped into a money laundering scheme and could be prosecuted. Don’t do it.

AI Voice Cloning Scams

Holidays are a time when we catch up with friends and relatives whom we haven’t spoken to in a while. I’ll admit this isn’t very common, but it is an emerging threat and I already have two personal stories from a relative and friend who experienced it first-hand. This is a very targeted attack, enabled by AI, where the fraudster will need access to voice clips. Where do they find them? Social media videos.

Tips for your customers and members

- Check your privacy settings on social media: Facebook, Instagram, Twitter/X, LinkedIn. Your videos are material for deep fakes. The more that are publicly available, the more you are exposed to deep fakes.

- Come up with a safety word or phrase to authenticate a weird conversation. Make it fun and easy to remember without including words or phrases a fraudster can discover on social media. Think of it as an inside joke that no one outside of your inner circle will ever understand. My family uses… you really think I’d share that in a public blog post?!

You have my permission to use any of this content to educate your customers and members. And if you need my help, I’m here for you, just email me to schedule a free chat. I promise you will come away with some insights and a trusted resource.

Happy Holidays!